Capital Gains Tax (CGT) | Upcoming payment dates are fasting approaching!

Under current tax legislation, a person is obliged to pay CGT on the disposal of an asset if a chargeable gain arises.

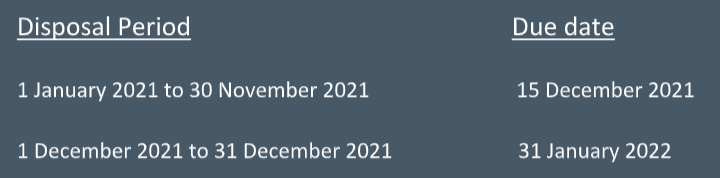

The pay and file deadlines are as follows:

The current rate of CGT is 33%.

Therefore, if you disposed of an asset between 01 January 2021 and 30 November 2021; or if you intend on disposing of an asset before 31 December 2021, please ensure that you get in contact with us.

Failure to pay the correct amount of tax by the relevant deadline could result in interest and penalties being applied by the Revenue Commissioners.

Where you have a CGT liability, consideration should be given to the crystallisation of CGT losses prior to 31 December 2021 and the utilisation of any reliefs available that may mitigate the amount of chargeable gain. There are a number of reliefs that individuals can avail of such as Retirement Relief, Same-Event Credit, Principal Private Residence Relief, and Entrepreneur Relief, among others.

If you would like more information on these reliefs, and whether they may apply to you, please feel free to contact us:

Sean McSweeney, Partner | sean@mc2group.ie

Kathy Leahy, Senior Manager | kathyl@mc2group.ie