The Department of Public Expenditure & Reform has recently announced changes to Civil Service mileage and subsistence rates. These changes will take effect from 1 April 2017 and it is expected that these rates will remain in place for the next 3 years.

The Revised Mileage Rates

Please note that the new rates do not apply to business travel between 1 January 2017 and 31 March 2017, however business travel during this period will, count towards aggregated mileage for the year.

Reminder of Key points when claiming business mileage

You can claim mileage from your workplace to another place of work however if you are making a business trip and travelling straight from home then the allowable business mileage is the shorter of (i) the mileage from your home place to the place where you are doing business that day or (ii) from your normal place of work to where you are doing business that day.

An employee’s “normal place of work” is the place where that employee normally carries out the duties of his/her employment. Please note that typically an employee’s home is not regarded as their normal place of work unless there is an objective requirement that the duties of his/her employment must be performed at home. In addition, it is not sufficient for an employee merely to carry out some of his/her duties at home for their home to be considered their normal place of work.

Mileage can be claimed in respect of business journeys i.e. journeys from one place of work to another place of work. Trips from an employee’s home to their normal place of work (and vice versa) are not considered to be business journeys and mileage in respect of such journeys cannot be claimed.

Information that employers should keep record of where their employees are reimbursed for motor expenses using Civil Service Mileage Rates:

- Name and address of the employee

- The date of the journey

- A detailed description of the place of departure, the destination, the purpose of the trip, the distance travelled and the basis for reimbursing the travel expenditure (e.g. temporary absence from normal place of work).

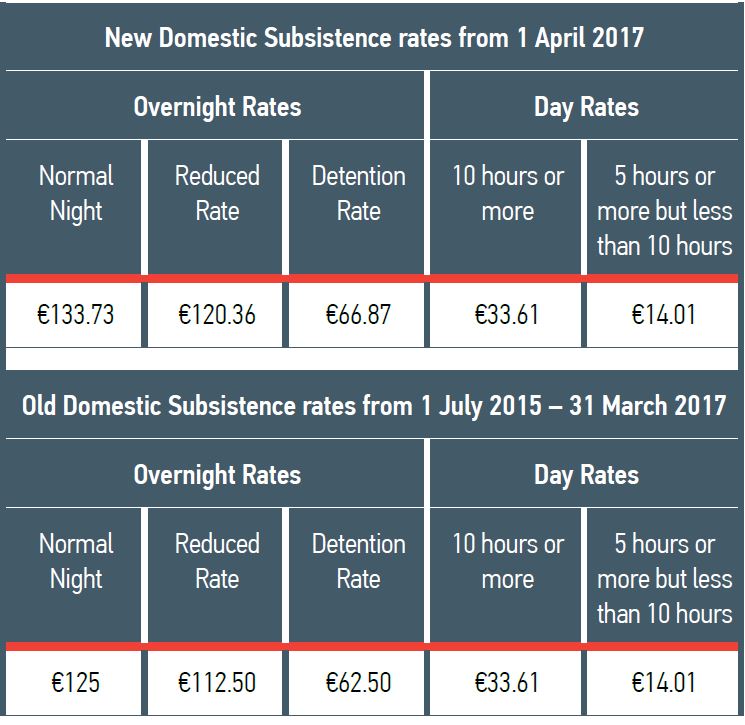

Overview of Changes to the Subsistence Rates

Please note that there has also been some slight changes to the Civil Service Subsistence Rates, the main changes include increased rates for the overnight allowances. No changes have been made to the day allowances. The changes to the overnight rates are summarised as follows: