Revenue are currently issuing 2019 Tax Credit Certificates (P2C’s) to all PAYE employees. We encourage you to review this important document now.

The Tax Credits Certificates are available online on the Revenue website in My Documents, which is accessed from myAccount.

It is your responsibility to ensure the details are correct and you are receiving the correct reliefs. If you are jointly assessed, the allocation of your tax credits, reliefs and standard rate cut-off point should be allocated correctly between spouses or civil partners to suit your own circumstances, or if you hold more than one job you can split the tax credits and rate bands between jobs. These amendments can be made online from within myAccount.

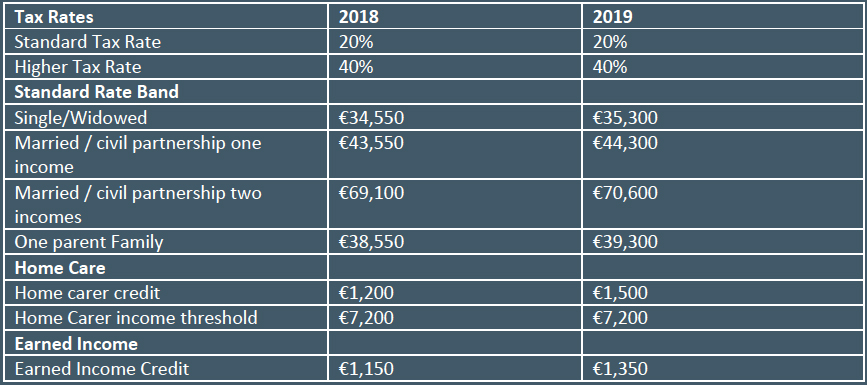

Tax Rates and Credits

Universal Social Charge (USC)

The above information is our overview, so we do recommend that you take a comprehensive review on the Revenue link below:

https://revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/index.aspx