Personal Tax Measures

- Effective from 1st January 2024, the following tax credits will increase by €100 p/a

- Personal Tax Credit €1,875

- Earned Income Credit €1,875

- PAYE Credit €1,875

- Home Carers Credit €1,800

- Single Person Child Carer Credit €1,750

- The incapacitated child tax credit will increase from €3,300 to €3,500.

- Rent tax credit will increase by 50%

- Single Person €750

- Couple (jointly assessed) €1,500

- The terms of the relief have been enhanced to allow student children who have tenancies in “Rent a Room” of “Digs” style accommodation to claim the rent credit for 2022 and 2023.

- The standard rate tax band will increase by €2,000 to €42,000, with proportionate increases for single person child carers, married couples, and civil partners.

- Introduction of a one-year mortgage interest tax relief for homeowners with an outstanding mortgage on their primary dwelling house of between €80,000 and €500,000

- Mortgage interest relief may be claimed for the 2023 tax year in respect of the increased interest charges paid in the period relative to the 2022 interest charges.

- The relief is capped at €1,250 per property.

- USC

- The third rate will decrease from 4.5% to 4%,

- There has been an increase in the 2% USC rate band from €22,920 to €25,760, and

- The reduced USC rates for medical card holders has been extended to the end of 2025.

- Effective from 01 October 2024, all PRSI rates will increase by 0.1%.

Social Welfare Benefits

The key social welfare enhancements were as follows.

- Minimum wage has been increased by €1.40 to €12.70.

- Households will receive three further credits of €150 each over the winter period to assist with rising energy costs (€450).

- Weekly social protection payments will increase by €12 per week.

- Recipients of the living alone allowance and fuel allowance will receive lump-sum payments of €200 and €300 respectively.

- For those in receipt of social welfare protection payments, the Christmas bonus will be paid in early December 2023. In addition, a once off double payment will be paid in January 2024.

- The domiciliary care allowance will increase by €10 per month. For recipients of the Carer’s support grant, disability allowance, blind pension, invalidity pension and domiciliary care allowance, a once-off payment of €400 will be made before Christmas.

- Child Benefit

- The rate will increase by €4 to €46 per week for under 12s and to €54 per week for overs 12s.

- Child benefit payment has also been extended for children over 18 years of in full time education.

- A once-off double payment will be made in respect of each qualifying child before Christmas.

- The hot school meals programme will be extended to a further 900 primary schools in April 2024.

- Free school book scheme has also been extended to all junior cycle pupils in secondary schools.

- From 1st September 2024, there will be a further 25% reduction in childcare costs under the national childcare scheme.

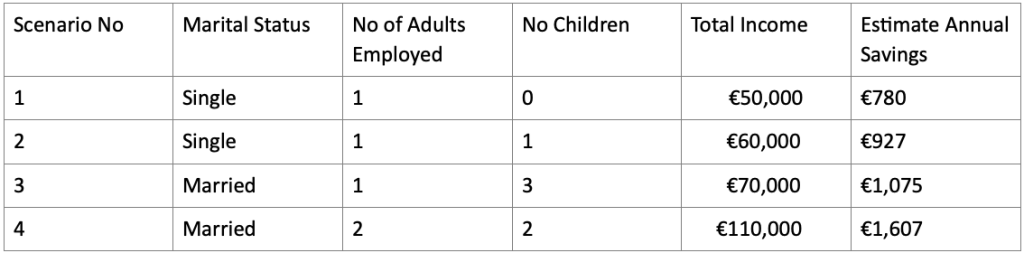

Financial & Tax Impact of Budget 2024

*Please note that these figures are for illustration purposes only, and do not take into consideration newly introduced measures such as mortgage interest relief, the rent credit, once off social welfare payment, etc.

Indirect Taxes

- From 1st January 2024, the VAT registration threshold for services will increase from €37,500 to €40,000. For goods the registration threshold will increase from €75,000 to €80,000.

- The temporary 9% VAT rate for the supply of gas and electricity has been extended for a further 12 months.

- The VAT rate applicable for audio and e-books will be reduced to 0%.

- The funds available for the VAT Compensation Fund are set to increase from €5m to €10m.

- The excise duty on a packet of 20 cigarettes will increase by 75c, with a pro-rata increase on all tobacco products over the next year.

- The increase in the fuel excise, which was due to come into effect on 31 October 2023, has been deferred to 2024.

Property Based Taxes

- The Vacant Homes Tax will be increased from 3-times the property’s existing base rate of LPT to 5-times the base rate. This increase will come into effect for the next chargeable period commencing this November.

- The original liability date for residential zone land tax has been deferred to 1 February 2025 to allow further engagement between landowners and local authorities.

- The Help-to-Buy scheme has been extended to December 2025.

- In recognition of vital role small-scale landlords play in the Irish rental market, a new temporary tax relief has been introduced. Rental income will be disregarded for income tax purposes at the standard rate as follows

- €3,000 for 2024

- €4,000 for 2025

- €5,000 for 2026 and 2027

Capital Taxes

- The following changes to CGT retirement relief will come into effect from 1st January 2025

- The upper age limit for claiming retirement relief will be extended from 65 to 70, and

- There will be a new limit of €10m on the relief available for disposals to a child up to the age of 70.

- A new capital gains tax relief will be introduced to encourage “angel investment”.

- The relief provides for a lower rate of CGT of 16% (or 18% where held through a partnership) for disposals of qualifying investments for gains up to a value of two times the original investment, with the standard 33% CGT rate continuing to apply to gains above this limit,

- The investment must be made in the form of fully paid-up newly issued shares costing at least €10,000,

- The investment must be held for a minimum period of three years, and

- The individual must hold between 5% and 49% of the ordinary issued share capital of the Company.

- Capital Acquisitions Tax: The Group B threshold should now apply in respect of all gifts/inheritances received by foster children from their foster siblings, the parents/ brother/sister of their foster parents etc.

Corporation Tax & Tax Based Incentives Schemes

- Legislation to implement the 15% minimum rate of corporation tax under the OECD Pillar Two Agreement will be published next week.

- A participation exemption for foreign sourced dividends should be legislated for in Finance Bill 2024.

- R&D Tax Credit

- The rate of the tax credit will increase from 25% to 30%.

- The amount of the credit available to be refunded to a Company as part of its first-year instalment has been increased from €25,000 to €50,000.

- Changes to the EII Scheme – Effective from 1st January 2024

- Standardising the minimum holding periods for all investments to four years.

- The maximum amount on which an investor can claim relief has increased from €250,000 per annum to €500,000.

- KEEP Scheme

- The scheme has been extended to 31 December 2025.

- The lifetime Company limit for KEEP shares has been increased from €3M to €6M.

- These charges are subject to a ministerial commencement order.

Energy & Climate Measures

- BIK on Company Cars.

- Relief of €10,000 in the Original Market Value (OMV) of certain vehicles has been extended to 31 December 2024.

- The tapering mechanism for the BIK relief on electric vehicles has been enhanced by reducing the deduction for the OMV as follows:

- Current deduction of €35,000 to be extended to 31 December 2025

- Reduction to €20,000 in 2026, and

- Reduction to €10,000 in 2027.

- The VRT relief for battery electric vehicles is being extended to the end of 2025.

- The VAT rate applicable for the supply and installation of solar panels in schools will be reduced from 13.5% to 0%, effective from 1st January 2024.

- The carbon rates for petrol and diesel per tonne of carbon dioxide emitted increased from €48.50 to €56 on 11 October 2023.

- The accelerated capital allowance scheme available to companies and unincorporated business who incur capital expenditure on specified products has been extended for another two years to 31 December 2025.