As you may be aware, the Irish Revenue Commissioners have introduced a new method to calculate the BIK arising on Company Vehicles (i.e. cars and vans). Although the changes were introduced in previous Finance Acts, the new rules did not come into effect until January 2023.

We have set out below a brief summary of the changes introduced.

Company Vans

For the year of assessment 2023 and onwards, the cash equivalent for Company Vans will be 8% (previously 5%) of the open market value (OMV) of the vehicle.

Company Cars: Non-Electric Vehicles

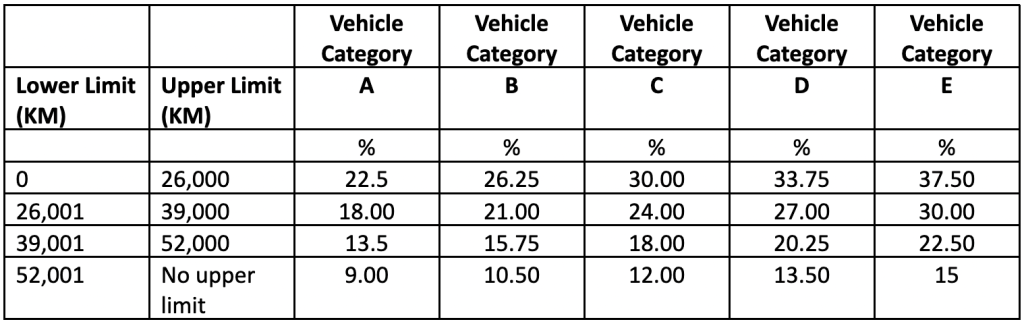

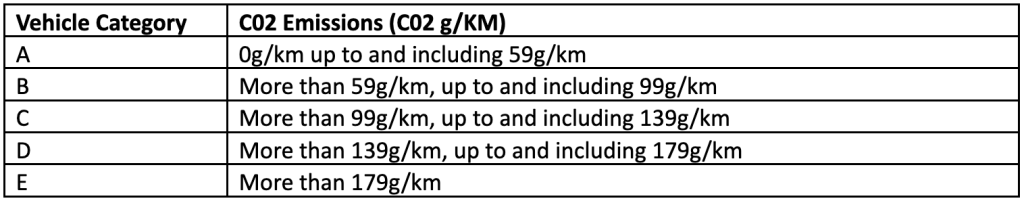

From 2023 onwards, the BIK cash equivalent on the use of the Company Car will be determined based on the business mileage undertaken and the CO2 emission level of the vehicle.

Set out in the table below are the applicable BIK rates.

For example, an employee has the use of a car provided by their employer on 1 January 2023. The OMV of the car is €30,000, and the car produces 90g/km in CO2 emissions. The actual business kilometres undertaken in the year are 35,000 kilometres.

Firstly, 90g/km in CO₂ emissions puts the car in vehicle Category B. As the employee drove 35,000 kilometres in the year, the cash equivalent is equal to the OMV x 21% (mileage between 26,001 and 39,000). Therefore, the annual BIK charge should be €30,000 x 21% = €6,300

Company Cars: Electric Vehicles

In respect of electric cars, although the Finance Act 2021 extended the favourable BIK regime for certain electric vehicles until the end of 2025, the relief has unfortunately been curtailed. The 0% BIK rate that previously applied on certain electric vehicles is being phased out on a tapered basis over the next three years.

For an electric vehicle made available for an employee’s private use during the years 2023 – 2025, the cash equivalent will be calculated based on the actual OMV of the vehicle reduced by:

- €35,000 in respect of vehicles made available in the 2023 year of assessment;

- €20,000 in respect of vehicles made available in the 2024 year of assessment; and

- €10,000 in respect of vehicles made available in the 2025 year of assessment.

If the reduction reduces the OMV to nil, a BIK charge will not arise. Any portion of OMV remaining after the reduction is applied will be subject to a tax charge. As all electric cars should have no CO2 emission levels, they fall within the scope of Vehicle Category A. Therefore, the applicable BIK rate will range from 9% to 22.5%, depending on the number of business KM undertaken in the year.

What should I do as an employer?

- If you, or your Company, has provided a Company Vehicle to an employee / director, please liaise with the payroll department / payroll agent to ensure the correct BIK rate is being charged on the vehicle;

- Ensure adequate travel records are maintained for all employees / directors. These records should be updated on a weekly / monthly basis, thereby ensuring the correct BIK is charged through payroll on a real time basis and is reflective of the business KM travelled;

- If you are considering providing an employee with a Company Vehicle, please liaise with your accountant / tax advisor first. Following the changes that came into effect this year, the provision of a Company Vehicle can result in a significant tax cost for both employee and employer;

- If it is your intention to provide an employee / director with a Company Vehicle, please discuss the specification of the asset with your accountant or tax advisor first. Very often cars which are advertised as commercial vehicles are still subject to the BIK rates applicable for passenger motor vehicles.

Should you have any questions in relation to the recent changes introduced, please do not hesitate to contact us on 021 486 1486 or by clicking here.

Additional information relating to the provision of Company Vehicles can be obtained from the Revenue website by clicking here.